TOPS 1099-NEC Tax Forms, Fiscal Year: 2023, Five-Part Carbonless, 8.5 x 3.5, 3 Forms/Sheet, 50 Forms Total (TOP22993NEC)

Part # TOP22993NEC

UPC 025932229398

Part # TOP22993NEC

UPC 025932229398

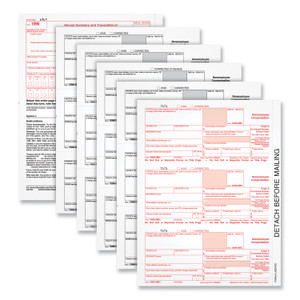

Get IRS Form 1099-NEC for up to 50 recipients. TOPS 1099-NEC pack includes 50, 5-part 1099-NEC sets and three 1096 summary forms. You'll use the 1099-NEC to report nonemployee compensation for your independent contractors and attorneys. This year there are two reporting updates for the NEC. 1) You can report payer-made sales of $5,000 or more on the NEC in box 2 OR on the MISC in box 7, so fewer filers will need both forms. 2) You can no longer report cash payments for the purchase of fish for resale in NEC box 1. (Use 1099-MISC box 11 instead.) The IRS has reduced the size of the NEC to fit 3 forms per sheet this year, so be certain to grab new NEC envelopes designed to fit 3-up forms.

| Brand | TOPS |

|---|---|

| Form Size | 8.5 x 11 |

| Forms Per Page | 2 |

| Form Quantity | 50 |

| Sheet Size | 8.5 x 11 |

| Principal Heading(s) | 1099-NEC |

| Printer Compatibility | Inkjet/Laser |

| Paper Color(s) | White |

| Pre-Consumer Recycled Content Percent | 0% |

| Post-Consumer Recycled Content Percent | 0% |

| Total Recycled Content Percent | 0% |

| Country of Origin | US |

| Prop65 | No |

| Unit of Measure | PK |

| Last Updated | 1/05/2021 |